We use tactics21 to evaluate AI performance.

hedge21 in figures: A real-world importer example from November 2015 till January

2018.

Fig. 1: EURUSD rates from 2016 until 2018.

❶ An importer case

An EU company buys crude oil

A corporation is seated in the EU an accounts in Euro. To operate their business, the corporation purchases crude oil, which is priced in USD.

If the EUR gains in value against the USD (the EUR rate goes up), the corporation will benefit from the rise.

If the EUR drops against the USD, the corporation, when exchanging the currencies, will get less USD for their EUR, and crude oil gets more expensive - independently from the price risk of crude

oil itself.

The corporation wants to protect itself against unfavourable exchange rates and implements a hedging policy.

Fig. 1: A hedging policy defines sets constraints and degrees of freedom.

❷ Defining a policy

A hedging policy is a treasurer's plan of action against currency exposure and for smoothing the company's EBIT. In this given case, he plans with a budget rate of 1.10 EURUSD.

In the given importer case, hedging starts from November 2015 and ends on January 31, 2018 (the "Expiry"). During the early 8 months of the 26-months hedging period, the corporate hedging policy allows any hedge size between a zero hedge and a full 100% hedge. From c. August 2016 on, the risk mitigation plan increases stepwise from a 25% to a 75% hedge ratio.

Within such boundaries given, either the human treasurer or a HEDGE21 digital assistant are allowed to act with freedom.

Fig. 3: A HEDGE21 digital assistant for dynamic hedging is busy while observing upper and lower boundaries of a given hedging policy.

❸ Start dynamic hedging

A dynamic HEDGE21 digital assistant suggests to scale in and out a hedge almost every day - it's a busy assistant observing all constraints and degrees of freedom a treasurer gives her.

There are four flavors of HEDGE21 digital assistants available - all combinations of dynamic, passive, performance-oriented and risk-averse properties. All of them compute an optimal hedge ratio once every day.

While a dynamic HEDGE21 digital assistant is supposed to both increase and decrease a hedge position, her passive peer may only increase a hedge.

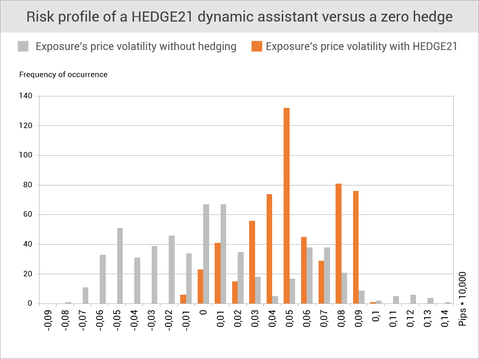

Fig. 3: Effect one: Much lower price volatility.

❹ Effect one: Lower downside

Without any hedge, the treasurer would have been exposed to an EURUSD rate fluctuating between 1,310 pips up and -870 pips down.

HEDGE21 decreased the exposure's price volatility and the treasurer's risk drastically. HEDGE21 decreased fluctuation to a maximum of 900 pips up and -120 pips down.

Spoken in US-Dollars: HEDGE21 reduced the downside risk from a maximum of -87,000 to -12,000 US-Dollar. The probability that a zero hedge outperfomed HEDGE21 was 2.77%.

Fig. 5: Effect two: Outperformed benchmarks.

❺ Effect two: Outperformance

In the given case, how did HEDGE21 benchmark against other strategies?

- Against the CFO's budget rate: +1080 pips

- Against the CFO's hedging policy: +541 pips

- Against a full 100% hedge: +994 pips

- Against a 50% hedge: +768 pips

- Against a 0% hedge: -302 pips

In the given case, HEDGE21 outperformed all benchmark strategies, except a zero hedge, a case which would occur in the given example with a probability of 2.77%.

LEGAL DISCLAIMER. This website and its associated documents (the “Website”) have been prepared by 21strategies GmbH and/or its affiliates ("21strategies") solely for information purposes with regard to their currency exposure related data product (the “Data Product”) and is being furnished through 21strategies solely for information purposes to assist the recipient in deciding whether to proceed with further analysis of the Data Product contemplated herein.

This Website is not a prospectus and does not constitute an offer or invitation or the solicitation of an offer for the sale or purchase of any assets or shares and shall not form the basis of, or constitute, any contract or binding offer. The information set out at this Website is preliminary and should not be relied upon for any purpose. Neither the receipt of this Website by any person, nor any information contained at this Website constitutes, or shall be relied upon as constituting, the giving of investment advice by 21strategies to any such person.

Recipients should conduct their own review and analysis of the Data Product, its vendor, prospects, results of operations and financial condition. Past performance

is not a guarantee of future results. Recipients should consider any procurement of the Data Product contemplated at this Website and its associated documents as a supplement to an overall

investment program.